- Reports a 250% increase in electric vehicles (EVs) and hybrid models between 2019 – 2023.

- 79% of UAE consumers and 72% in KSA are considering electric vehicles (EVs) for their next vehicle purchase.

- Online automotive marketplaces such as Dubizzle and DubiCars hold a combined 73% marketshare, followed by YallaMotor and OpenSooq at 13% and 11%, respectively.

UAE, August 2024: AutoData Middle East, a leading automotive data solutions provider and subsidiary of World Automotive Group (WAG), has published its bi-annual report on the GCC used car market. It highlights the rising demand for EVs, residual values, key trends in consumer behaviours, transforming customer purchasing journeys and the growing influence of Chinese brands in the region.

Offering a comprehensive overview of the current competitive landscape, AutoData Middle East supports buyers and sellers to navigate the complexities of the used car sector with confidence and transparency. Five key factors were prominent throughout the report:

Burgeoning Demand for EVs

The demand for electric vehicles (EVs) in the UAE and KSA is on the rise, bolstered by government initiatives and the expansion of EV infrastructure. As of 2024, the UAE ranks eighth globally in EV market readiness, supported by an estimated 325 charging stations.

With a growing focus on sustainability, 79% of UAE consumers and 72% of KSA consumers are considering EVs for their next vehicle purchase. The UAE market share of EVs is expected to increase significantly, projected to be more than 15% by 2030. Dubai reached 25,929 EVs, while Abu Dhabi witnessed an EV fleet growth of up to 2,441 models by Q4 2023.

In the Middle East, countries such as the UAE and KSA have set ambitious targets to facilitate the adoption of EVs. The UAE government aims to expand its EV charging infrastructure to 10,000 stations by 2030, to reach 50% electric and hybrid vehicles by 2050. This sustainable target is also reflected in Dubai, as the Emirate aims to transition its taxi fleet to 100% eco-friendly vehicles including hybrid, EV and hydrogen-powered models by 2027. Furthermore, as part to of the Saudi Vision 2030, KSA’s Public Investment Fund (PIF) aims to roll out 5,000 fast charging stations by 2030.

This shift towards sustainable transportation has resulted in a rise in EV sales on marketplaces such as DubiCars, which saw a 45% increase from 2022 to 2023, with a further 13% expected growth in 2024.

Residual Value Performances

AutoData’s latest research on residual values reveals that used electric and hybrid vehicles are outperforming petrol and diesel vehicles in the UAE. The report revealed a 250% increase in EVs and hybrid models over the past five years, driven by a burgeoning interest and investment in EVs, with many automotive brands introducing a range of models to meet this demand.

SUVs continue to show substantial value retention compared to sedans. Premium and luxury vehicles, despite their price points, have resulted in a decline in residual value after a few years due to higher maintenance costs.

GCC-Compliance

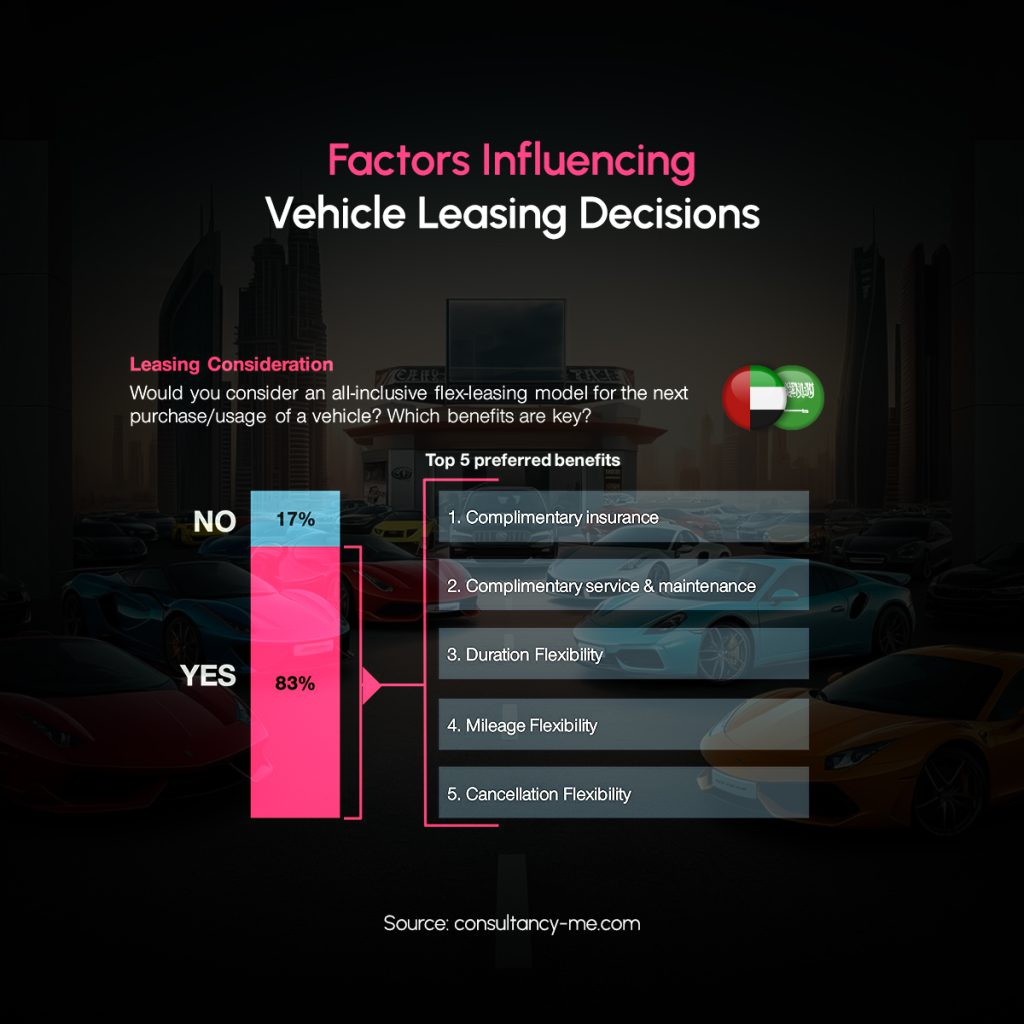

The report highlights a notable increase in the demand for GCC-spec vehicles, with 86% of Vehicle Report users identifying as buyers, primarily interested in models from 2015 and 2020. Toyota and Nissan continue to dominate the market, with capturing 24.8% and 17.1% of the market share in Q1 2024, respectively. Additionally, drivers are increasingly opting for vehicle leasing services with 83% showing willingness to consider leasing contracts. This is due to the flexibility leasing options offer drivers, including complimentary services such as free insurance, servicing and maintenance, lease duration and mileage flexibility, and more.

Purchasing Vehicles in the Digital Landscape

Consumers in the UAE and KSA are increasingly opting to begin their car-buying journey digitally, highlighting a clear preference for online research before making in-store visits. This integrated approach underscores the need for automotive market players to provide a seamless transition between online and offline channels.

According to Consultancy Middle East’s customer survey, 83% of respondents prefer to begin their purchasing journey via dealer websites, while 85% still favour in-store negotiations. This trend highlights the importance of a seamless integration between marketplace platforms and physical showrooms, offering convenient customer experiences.

Platforms such as Dubizzle and DubiCars dominate the digital landscape with a combined 73% market share due to expansive inventories and integrated user-friendly interfaces, while other market players such as YallaMotor holds 13% and OpenSooq occupies 11% market share. The remaining 3% is shared across Cars24 and smaller players with detailed listings and services such as inspections, financing, and more.

The Rise of Chinese Brands

Chinese automotive brands are quickly gaining a strong foothold in the UAE’s automotive sector. AutoData highlights the demand for Chinese cars has increased by 150% in June 2024 compared to 2023 across marketplaces such as DubiCars. Consumers are increasingly favouring these brands over traditional American, Japanese and European options, driven by key factors including affordability and high-tech features. For example, the average price for a new Chinese hatchback is 34.5% lower than an American model.

With diverse product offerings, improved quality and implementation of innovative technology, Chinese automotive brands are cementing their foothold in the region. According to DubiCars, Chinese brands have increased their market share from 0.58% in 2022 to 2.68% in 2023. In the UAE, leading brands include Jetour, Changan, BYD (Build Your Dreams), JAC, and Chery.

“At AutoData Middle East, we are at the forefront of the dynamic and rapidly evolving used car market in the region. Our commitment to transparency and confidence is reflected in the innovative tools we provide, such as the Vehicle Report, which offers detailed insights into a vehicle’s past, including accident history, previous ownership, and market valuations. We are excited to launch our new B2B tool – DealRevs – that empowers used car businesses, dealers, and stakeholders with real-time data, enabling them to make more informed decisions and accurately assess price points when buying and selling vehicles. Our services are invaluable for both consumers and businesses looking to navigate the complexities of the growing used car market,” concludes Sebastian Fuchs, Managing Director of AutoData Middle East.

For further information on AutoData Middle East’s innovative automotive data solutions, please visit: www.autodatame.com and www.vehiclereport.me